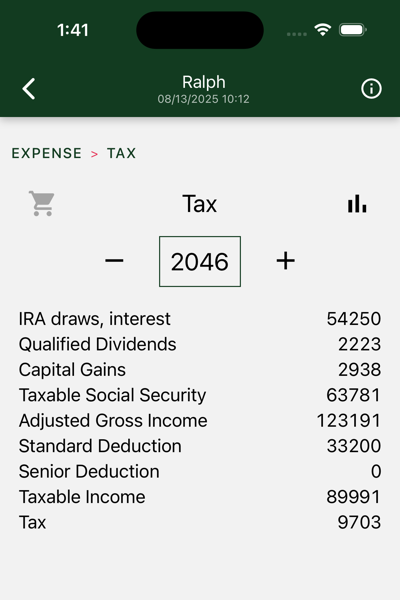

Hedgematic computes a tax return for each year of your retirement and includes the so-estimated taxes in your draw, over and above your required expenses. Displayed here is an estimated tax return.

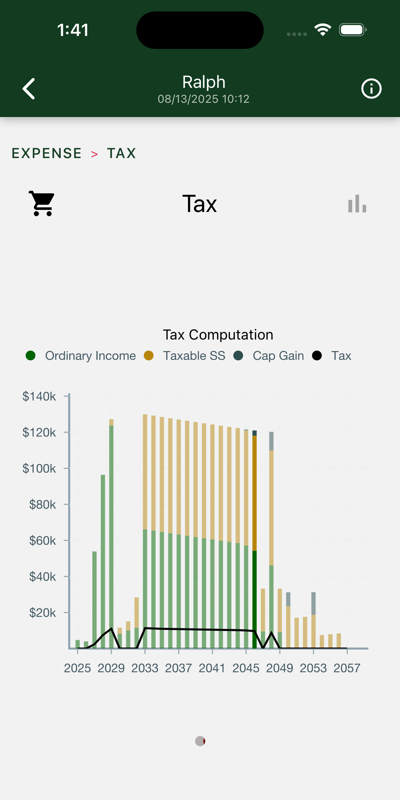

Charts

One chart is displayed.

Tax Computation

Bars represent entries on your 1040.

- Ordinary Income includes interest on bonds and withdrawals from your IRA.

- Taxable SS is that portion of Social Security subject to income taxes.

- Cap Gain includes reinvested (Qualified) S&P Dividends and gains on S&P sales.

The line at the bottom displays your total tax liability.

Note: Check out the smooth descent of the tax inputs in the middle of the chart. What is happening here is that Hedgematic is holding taxable income constant at the top of the 12% bracket. Taxable social security is not indexed for inflation. As it bites more, less room remains for IRA draws, which are consequently steadily decreased. The IRA is being systematically rolled to Roth without ever leaving the 12% bracket. By 2049, the IRA is zeroed out, the taxable social security plummets, and taxes go to zero.