Social Security

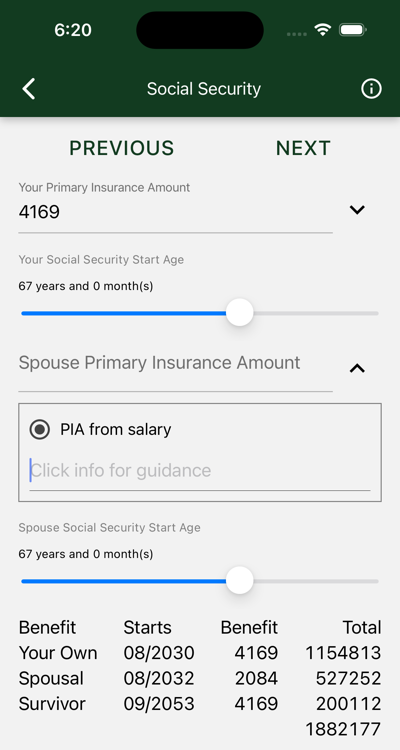

Hedgematic incorporates your social security payments into your profile and uses them in its computations. Use this dialog to provide social security information for you and your spouse.

Social Security Terms

Social Security, and Hedgematic, use certain terms to discuss Social Security concepts:

- Your Start Age is the age, expressed in years and months, you start taking Social Security benefits.

- Your Full Retirement Age, or FRA, is the Start Age where Social Security says you get your “full benefit”. It is determined by the year you were born.

- Your Primary Insurance Amount, or PIA, is the gross benefit you get if you retire at your FRA.

- Your Gross Benefit is your benefit before Medicare or other deductions.

- Your Social Security check is your gross benefit less deductions.

- If you start Social Security before or after your FRA, you get a smaller or larger gross benefit.

Hedgmatic uses your PIA and start age to compute your gross benefit. If you don’t know your PIA, Hedgematic can use your start age and associated gross benefit to compute your PIA.

You can see these numbers by creating a Social Security account at ssa.gov/myaccount. You also may get a yearly mailed Social Security Statement that contains the same information. Depending on your age, and whether or not you are already taking Social Security, different figures are provided:

- If you are already taking social security, you see gross benefit, but no PIA.

- If you are not yet taking Social Security,

- And you are younger than your FRA, you see your PIA, aka “estimated benefit at full retirement age.

- If you have passed FRA, you see the gross benefit if you retire today, from which the PIA can be computed.

Filling in the Primary Insurance Amount

I don’t have my Social Security Statement

Hedgematic will create a rough estimated PIA based on your current salary.

- Drop the helper in the “Primary Insurance Amount” field.

- Select “Salary”.

- Enter yearly salary

- Helper closes, estimated PIA is shown.

I’m Already Taking Social Security

- Drop the helper in the “Primary Insurance Amount” field.

- Select “Benefit”.

- Enter gross benefit (your check before deductions). This is also available on your SSA account, or your yearly mailed COLA letter.

- Helper closes, estimated PIA is shown.

I’m Younger Than 62

- You don’t see the Benefit helper. It only works if you are old enough for Social Security. Use the salary estimator, or,

- Your PIA is called out on your Social Security Statement. Enter PIA in the “Primary Insurance Amount” field.

I’m Older Than 62 and not taking Social Security

- If you are younger than your full retirement age, your statement provides your PIA. You can go ahead and enter it.

- Once you are past full retirement age, your statement no longer tells you your PIA. It does, however, tell you your gross benefit if you retire at your current age.

- Drop the helper in the “Primary Insurance Amount” field.

- Select “Benefit”.

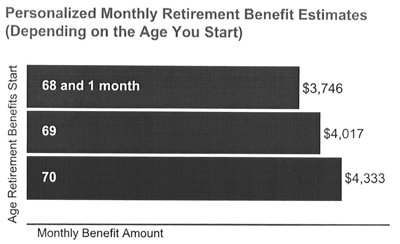

- Enter your Personalized Monthly Retirement Benefit Estimate for your current age. Below, the number is $3746.

- Helper closes, estimated PIA is shown.

Setting the Social Security Start Age

Start Ages for you and your spouse are initially set to your FRAs.

Drag the slider to try different start ages.

After changes are made, updated social security benefits are displayed and totaled. Numbers are in today’s dollars. Your actual check will increase with inflation every year.

Important: Your social security start age need have no relationship to the day you stop working. Depending on your assets and expenses, you can often retire well before your first social security check.