TIPS Bond

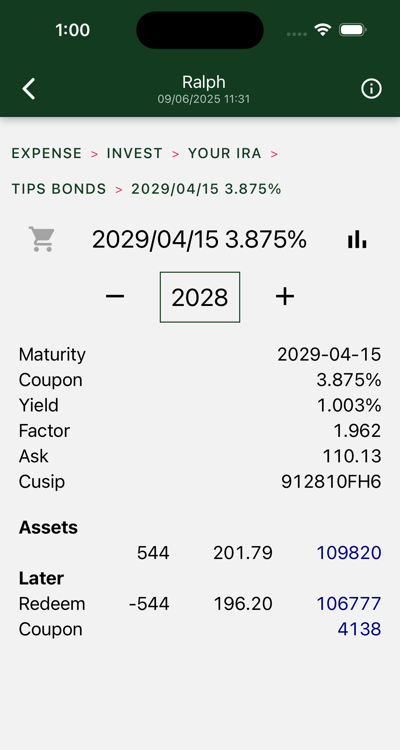

The information at the top of the page is commonly available when shopping for bonds.

- Maturity is the date you get your redemption and last coupon. The redemption amount is computed by multiplying the factor and the number of bonds.

- Coupon is paid twice a year. The coupon value is computed by multiplying the coupon rate and the factor and dividing by two. 3.875 * 1.962 / 2 = $3.80 for each bond, twice a year. 544 * $380 * 2 = the $4138 coupon value at the bottom of the page.

- Yield is the real yield, in constant dollars. Your bonds will earn both real yield and inflation adjustments.

- Factor tells you how much inflation has been added to this bond already. Here, the 1.962 tells you the bond, initially sold for $100, will be redeemed for almost $200 in current dollars, thanks to the power of compound inflation.

- The ask is provided you as if the bond was still $100. Multiply ask and factor to get what you will pay for this bond. In this case, it cost $216.07.

- The Cusip is an id you can use to search for a particular bond issue.

At the Broker’s

Visit your broker’s Treasury Bonds page. Locate the TIPS bonds.

Each issued bond has a maturity date and a coupon rate. Find the bond that matches the first two columns.

Buy the quantity shown in the third column. This is tricky. The amount you order is not the amount you pay.

- These bonds have a “par value” of $100. If you want 158 bonds, you order 158 times $100 or $15800 (depending on broker, likely rounded to the nearest thousand).

- The amount you pay, estimated in the fourth column, doesn’t match the order amount, and doesn’t match the figure in the fourth column. Your job is to turn the par value knob, and check whether the displayed cost amount is close.

The actual price of the bond is computed as the Factor times the Ask.

- The Factor accounts for the inflation adjustment applied since the bond was issued.

- The Ask responds to the Yield, and varies continuously throughout a session.

The amount you pay also includes adjustments to compensate the previous owner for their share of the next coupon.

Your broker will likely offer a ladder builder, where you can enter all the bonds you want first, then buy them in a single transaction.

Charts

Three charts are shown. Swipe to view each in turn.

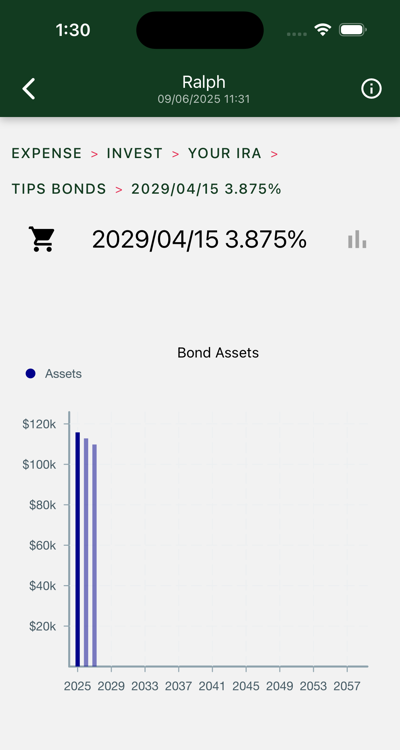

Bond Assets

Present value of bond declines as coupons are paid out.

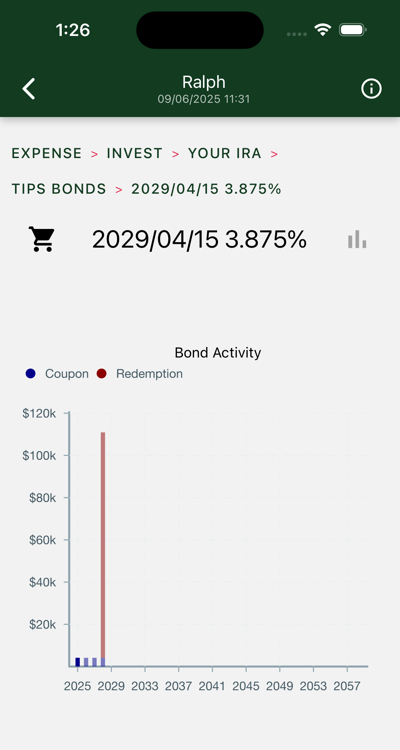

Bond Activity

See small coupons followed by big redemption.

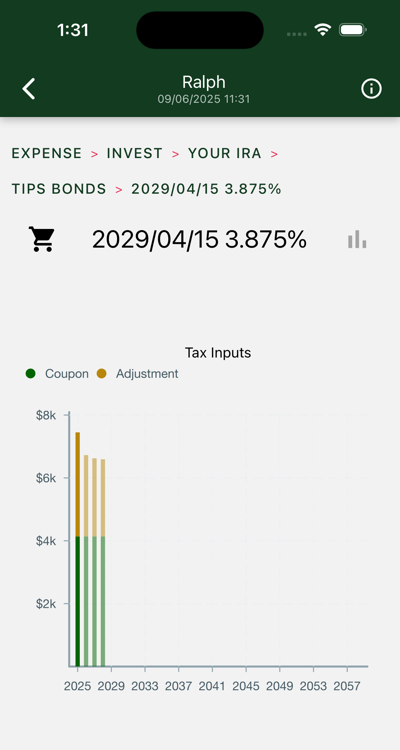

Tax Inputs

The coupons are in today’s dollars. Your adjustments will vary. If the bond is held in a broker account you will have to pay taxes on both coupons and adjustments. These adjustments are estimates from yield curve data of future inflation rates.